SEC. 25F. QUALIFIED ELEMENTARY AND SECONDARY EDUCATION SCHOLARSHIPS.

(a) Allowance of Credit.--In the case of an individual who is a citizen or resident of the United States (within the meaning of section 7701(a)(9)), there shall be allowed as a credit against the tax imposed by this chapter for the taxable year an amount equal to the aggregate amount of qualified contributions made by the taxpayer during the taxable year.

(b) Limitations.--

(1) In general.--The credit allowed under subsection (a) to any taxpayer for any taxable year shall not exceed $1,700.

(2) Reduction based on state credit.--The amount allowed as a credit under subsection (a) for a taxable year shall be reduced by the amount allowed as a credit on any State tax return of the taxpayer for qualified contributions made by the taxpayer during the taxable year.

(c) Definitions.--For purposes of this section--

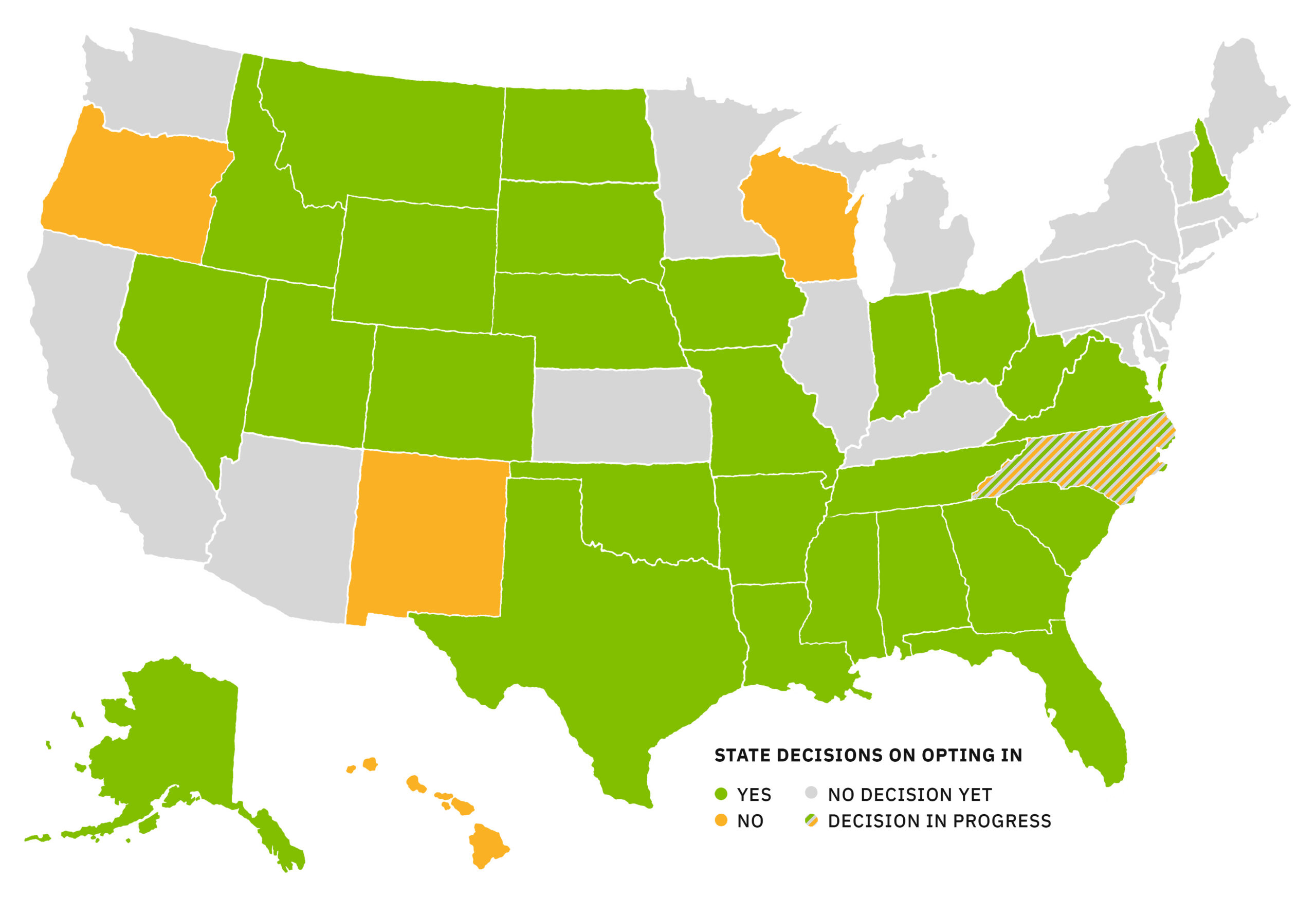

(1) Covered state.--The term 'covered State' means one of the States, or the District of Columbia, that, for a calendar year, voluntarily elects to participate under this section and to identify scholarship granting organizations in the State, in accordance with subsection (g).

(2) Eligible student.--The term 'eligible student' means an individual who--

(A) is a member of a household with an income which, for the calendar year prior to the date of the application for a scholarship, is not greater than 300 percent of the area median gross income (as such term is used in section 42), and

(B) is eligible to enroll in a public elementary or secondary school.

(3) Qualified contribution.--The term 'qualified contribution' means a charitable contribution of cash to a scholarship granting organization that uses the contribution to fund scholarships for eligible students solely within the State in which the organization is listed pursuant to subsection (g).

(4) Qualified elementary or secondary education expense.--The term 'qualified elementary or secondary education expense' means any expense of an eligible student which is described in section 530(b)(3)(A).

(5) Scholarship granting organization.--The term 'scholarship granting organization' means any organization--

(A) which--

(i) is described in section 501(c)(3) and exempt from tax under section 501(a), and

(ii) is not a private foundation,

(B) which prevents the co-mingling of qualified contributions with other amounts by maintaining one or more separate accounts exclusively for qualified contributions,

(C) which satisfies the requirements of subsection (d), and

(D) which is included on the list submitted for the applicable covered State under subsection (g) for the applicable year.

(d) Requirements for Scholarship Granting Organizations.--

(1) In general.--An organization meets the requirements of this subsection if--

(A) such organization provides scholarships to 10 or more students who do not all attend the same school,

(B) such organization spends not less than 90 percent of the income of the organization on scholarships for eligible students,

(C) such organization does not provide scholarships for any expenses other than qualified elementary or secondary education expenses,

(D) such organization provides a scholarship to eligible students with a priority for--

(i) students awarded a scholarship the previous school year, and

(ii) after application of clause (i), any eligible students who have a sibling who was awarded a scholarship from such organization,

(E) such organization does not earmark or set aside contributions for scholarships on behalf of any particular student, and

(F) such organization--

(i) verifies the annual household income and family size of eligible students who apply for scholarships to ensure such students meet the requirement of subsection (c)(2)(A), and

(ii) limits the awarding of scholarships to eligible students who are a member of a household for which the income does not exceed the amount established under subsection (c)(2)(A).

(2) Prohibition on self-dealing.--

(A) In general.--A scholarship granting organization may not award a scholarship to any disqualified person.

(B) Disqualified person.--For purposes of this paragraph, a disqualified person shall be determined pursuant to rules similar to the rules of section 4946.

(e) Denial of Double Benefit.--Any qualified contribution for which a credit is allowed under this section shall not be taken into account as a charitable contribution for purposes of section 170.

(f) Carryforward of Unused Credit.--

(1) In general.--If the credit allowable under subsection (a) for any taxable year exceeds the limitation imposed by section 26(a) for such taxable year reduced by the sum of the credits allowable under this subpart (other than this section, section 23, and section 25D), such excess shall be carried to the succeeding taxable year and added to the credit allowable under subsection (a) for such taxable year.

(2) Limitation.--No credit may be carried forward under this subsection to any taxable year following the fifth taxable year after the taxable year in which the credit arose. For purposes of the preceding sentence, credits shall be treated as used on a first-in first-out basis.

(g) State List of Scholarship Granting Organizations.--

(1) List.--

(A) In general.--Not later than January 1 of each calendar year (or, with respect to the first calendar year for which this section applies, as early as practicable), a State that voluntarily elects to participate under this section shall provide to the Secretary a list of the scholarship granting organizations that meet the requirements described in subsection (c)(5) and are located in the State.

(B) Process.--The election under this paragraph shall be made by the Governor of the State or by such other individual, agency, or entity as is designated under State law to make such elections on behalf of the State with respect to Federal tax benefits.

(2) Certification.--Each list submitted under paragraph (1) shall include a certification that the individual, agency, or entity submitting such list on behalf of the State has the authority to perform this function.

(h) Regulations and Guidance.--The Secretary shall issue such regulations or other guidance as the Secretary determines necessary to carry out the purposes of this section, including regulations or other guidance--

(1) providing for enforcement of the requirements under subsections (d) and (g), and

(2) with respect to recordkeeping or information reporting for purposes of administering the requirements of this section.

(2) Conforming amendments.--

(A) Section 25(e)(1)(C) is amended by striking "and 25D" and inserting "25D, and 25F".

(B) The table of sections for subpart A of part IV of subchapter A of chapter 1 is amended by inserting after the item relating to section 25E the following new item:

"Sec. 25F. Qualified elementary and secondary education scholarships.".

(b) Exclusion From Gross Income for Scholarships for Qualified Elementary or Secondary Education Expenses of Eligible Students.--

(1) In general.--Part III of subchapter B of chapter 1 is amended by inserting before section 140 the following new section:

"SEC. 139K. SCHOLARSHIPS FOR QUALIFIED ELEMENTARY OR SECONDARY EDUCATION EXPENSES OF ELIGIBLE STUDENTS.

(a) In General.--In the case of an individual, gross income shall not include any amounts provided to such individual or any dependent of such individual pursuant to a scholarship for qualified elementary or secondary education expenses of an eligible student which is provided by a scholarship granting organization.

(b) Definitions.--In this section, the terms 'qualified elementary or secondary education expense', 'eligible student', and 'scholarship granting organization' have the same meaning given such terms under section 25F(c).".

(2) Conforming amendment.--The table of sections for part III of subchapter B of chapter 1 is amended by inserting before the item relating to section 140 the following new item:

"Sec. 139K. Scholarships for qualified elementary or secondary education expenses of eligible students.".

(c) Effective Date.--

(1) In general.--Except as otherwise provided in this subsection, the amendments made by this section shall apply to taxable years ending after December 31, 2026.

(2) Exclusion from gross income.--The amendments made by subsection (b) shall apply to amounts received after December 31, 2026, in taxable years ending after such date.